Trailer

Toggle light

Comments

56 Views

Report

FavoriteIf current server doesn't work please try other servers below.

Server

Vidsrc

Server

1080P Only No ads

Server

GD

Server

StreamBucket

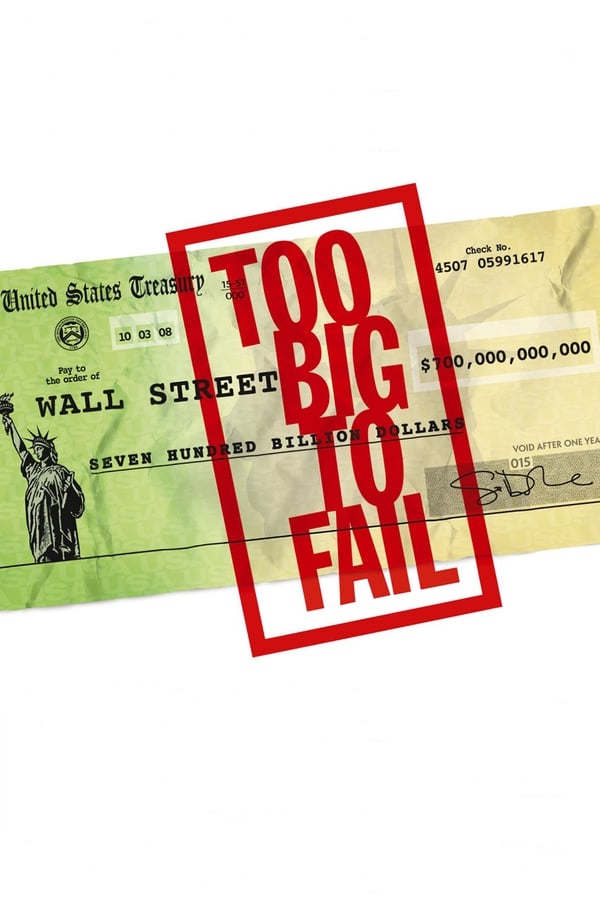

Too Big to Fail 2011 Full Movie Free

Too Big to Fail Full Movie Free: A Deep Dive into the 2008 Financial Crisis

In 2008, the world was captivated by the unfolding mortgage industry crisis, with news channels flooded with reports about the forced sale of the troubled investment bank, Bear Stearns, to the commercial banking giant JPMorgan Chase, backed by Federal guarantees. This pivotal moment set the stage for the next major player in the financial drama: Lehman Brothers.

The Downfall of Lehman Brothers

As Bear Stearns exited the scene, short sellers quickly turned their attention to Lehman Brothers, whose share price began to plummet. In a desperate attempt to salvage their situation, Lehman sought to negotiate a deal with Korean investors. However, the deal was contingent on excluding Lehman’s toxic real estate assets, a condition that fell apart when CEO Dick Fuld insisted that the Koreans reconsider accepting these liabilities.

Meanwhile, the most promising U.S.-based buyer, Bank of America, showed little interest in acquiring Lehman without Federal involvement. U.S. Treasury Secretary Henry Paulson remained firm, insisting that the government would not subsidize any further acquisitions. This refusal set the stage for a dramatic weekend meeting.

Emergency Meetings and Failed Negotiations

To address the escalating crisis, Paulson and Timothy Geithner, President of the Federal Reserve Bank of New York, convened the leaders of the largest U.S. banks. Their goal was to persuade these financial giants to underwrite a deal for Lehman Brothers. Although an agreement seemed within reach, Bank of America ultimately backed out, opting instead to acquire another struggling firm, Merrill Lynch, which was also a rival to Lehman.

In a last-ditch effort, Paulson attempted to negotiate with British bank Barclays, but British banking regulators blocked their involvement. With no viable buyers left, Lehman Brothers was forced into bankruptcy, marking a significant turning point in the financial landscape.

The Ripple Effect of Lehman’s Collapse

The collapse of Lehman Brothers sent shockwaves throughout the entire financial system. Paulson faced the media, trying to reassure the public about the soundness of the decision to let Lehman fail. However, the stock market reacted violently, entering a freefall that left investors reeling. Compounding the crisis, insurance giant AIG also began to falter.

French Finance Minister Christine Lagarde warned Paulson that allowing AIG to fail would have dire consequences, particularly for Europe. Unlike Lehman, the U.S. Treasury intervened, rescuing AIG with an $85 billion loan, deeming it “too big to [let] fail.”

Legislative Action and the Troubled Asset Relief Program

As the crisis deepened, Ben Bernanke, Chairman of the Federal Reserve System, argued that Congress needed to pass legislation to authorize any continued intervention by the Fed or the Treasury. With credit availability dwindling, Paulson proposed a plan to purchase toxic assets from banks, aiming to alleviate their financial burdens and restore cash reserves.

Similar Content

Bernanke and Paulson lobbied Congress, emphasizing the potential fallout that could be worse than the Great Depression if action was not taken. Just as a committee of representatives appeared close to reaching an agreement, U.S. Senator and Presidential candidate John McCain made a dramatic announcement: he was suspending his campaign to return to Washington and work on the legislation.

Political Maneuvering and the Passage of TARP

Paulson found himself in a precarious position, having to threaten McCain not to interfere and pleading with Democrats to remain engaged in negotiations. After a wave of panic and personal appeals from President George W. Bush, the legislation finally passed on a second attempt, leading to the creation of the Troubled Asset Relief Program (TARP).

Realizing that buying toxic assets would take too long, Paulson’s team shifted focus to direct capital injections into the banks as a means to utilize TARP effectively. Alongside FDIC Chair Sheila Bair, Paulson informed the banks that they would receive mandatory capital injections. While the banks agreed to the loans, TARP legislation did not compel them to use the funds to restore credit for ordinary consumers.

The Aftermath and Lessons Learned

The stock market continued its downward trajectory until 2009, when it finally stabilized, signaling the end of the immediate crisis. An epilogue reveals that the banks made little use of the loan money to ease credit conditions as intended, while Wall Street compensation soared, reaching an astonishing $135 billion by 2010.

Conclusion: Watch Too Big to Fail Full Movie Free

The story of the 2008 financial crisis, as depicted in “Too Big to Fail,”

You may also like

×